In 2025, personal finance and investment are no longer domains reserved for experts or institutions. With the rise of AI-driven analytics, blockchain-backed security, and hyper-personalized financial planning, ordinary individuals now wield powerful tools once exclusive to professional traders and advisors. Managing money in the digital era is about clarity, control, and empowerment.

The financial apps of 2025 reflect this democratization of wealth management. Among countless platforms, three stand out: FinGuard AI, WealthNest, and CryptoBridge X. Each app addresses a vital component of modern finance—personal budgeting and security, long-term investment growth, and the integration of digital assets into everyday portfolios. Together, they symbolize the transformation of financial management into a transparent, intelligent, and inclusive ecosystem.

FinGuard AI – Intelligent Budgeting and Security

Description (100 words)

FinGuard AI is a comprehensive personal finance app designed to make money management secure and intuitive. It tracks income, expenses, and savings in real time, using AI to provide actionable insights into spending habits. Unlike older budgeting apps, FinGuard emphasizes security by integrating biometric authentication, fraud detection, and blockchain-encrypted transactions. It also acts as a financial guardian, issuing alerts about unusual activity and offering personalized recommendations to improve savings. The app adapts to life stages, whether managing student loans, mortgages, or retirement funds. FinGuard AI ensures that financial control is no longer stressful but a proactive, intelligent process.

In-Depth Analysis

FinGuard AI thrives at the intersection of security and usability. By applying machine learning to spending patterns, it helps users recognize wasteful habits while reinforcing financial discipline. Its fraud detection system, which instantly identifies suspicious activity, has made it a trusted partner in daily financial life. The app also offers simulations—allowing users to preview how financial decisions, like taking out a loan or investing in a home, will impact their long-term stability. FinGuard AI resonates with young professionals and families alike, bridging everyday banking with strategic planning. In 2025, it stands as a symbol of trust in the digital financial era.

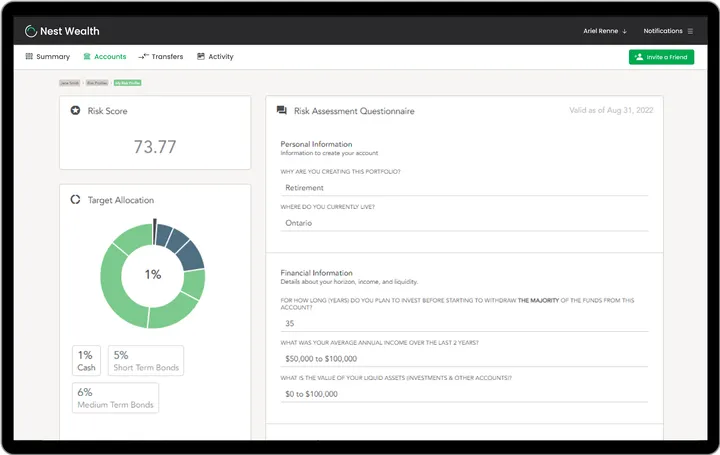

WealthNest – Personalized Investment Growth

Description (100 words)

WealthNest is the premier investment app of 2025, specializing in AI-driven portfolio management. It analyzes user profiles—including income, risk tolerance, and future goals—to build personalized investment strategies. WealthNest adapts to changing markets in real time, rebalancing portfolios to maximize growth while minimizing risks. It integrates traditional assets like stocks and bonds with emerging opportunities such as green energy, biotech, and space exploration. WealthNest also features “Wealth Communities,” where users share insights and learn collaboratively. Designed to turn even beginners into confident investors, the app empowers users to grow wealth strategically, transforming financial planning into a guided, engaging journey.

In-Depth Analysis

WealthNest exemplifies the democratization of investment. Where once professional advisors and hedge funds had the upper hand, WealthNest now places advanced financial strategies in the pockets of ordinary people. Its AI constantly monitors markets, executing micro-adjustments that optimize growth opportunities. The integration of educational features also differentiates it—new investors learn alongside automated management, building both confidence and knowledge. The inclusion of sustainable and future-forward assets appeals to younger investors seeking both returns and impact. In 2025, WealthNest transforms investment into a personalized and participatory process, bridging the gap between financial literacy and wealth creation.

CryptoBridge X – The Gateway to Digital Assets

Description (100 words)

CryptoBridge X is the definitive app for navigating the world of digital assets in 2025. More than a cryptocurrency wallet, it is a complete platform for managing blockchain-based investments, from tokens and NFTs to decentralized finance projects. The app simplifies complex blockchain concepts through AI-powered dashboards, making digital assets accessible to everyday users. It also integrates compliance features, ensuring that transactions align with evolving global regulations. CryptoBridge X enables cross-border payments, instant peer-to-peer lending, and tokenized real estate investments. For individuals seeking to diversify portfolios with digital wealth, CryptoBridge X is the trusted bridge between traditional finance and blockchain innovation.

In-Depth Analysis

CryptoBridge X reflects how digital assets have matured into mainstream finance. Unlike the volatile, confusing landscape of early cryptocurrency, the app offers clarity, security, and accessibility. Its dashboards present real-time market movements alongside risk assessments, enabling informed decision-making. For global users, its cross-border payment system eliminates traditional banking delays, making financial transfers instantaneous. Its ability to integrate with traditional banking apps has further legitimized digital assets, reducing the gap between fiat and blockchain-based wealth. In 2025, CryptoBridge X is not only an investment tool but also a gateway to the decentralized economy shaping the future of global finance.

Comparative Perspective

The three apps reveal different but complementary dimensions of personal finance in 2025:

- FinGuard AI ensures financial health through security and intelligent budgeting.

- WealthNest transforms investment into a guided, AI-driven journey of growth.

- CryptoBridge X connects users to the new frontier of digital assets and decentralized finance.

Together, they reflect a financial ecosystem where individuals are empowered to protect, grow, and diversify their wealth with unprecedented ease and confidence.

The Broader Context of Finance in 2025

- AI-Driven Empowerment – Advanced analytics empower individuals to manage money like professionals.

- Integration of Digital Assets – Cryptocurrencies, NFTs, and tokenized investments become part of everyday portfolios.

- Security and Transparency – Users demand biometric protection, blockchain records, and fraud prevention.

- Financial Inclusion – Apps lower entry barriers, allowing people from all backgrounds to participate in global markets.

- Values-Driven Investing – Sustainability, ethics, and future-focused industries become core investment categories.

Conclusion

The top three finance apps of 2025—FinGuard AI, WealthNest, and CryptoBridge X—redefine how individuals approach money management. They secure finances, democratize investing, and bridge the gap between traditional and digital economies.

Finance in 2025 is no longer intimidating or exclusive. With these tools, managing money becomes an act of empowerment, education, and opportunity. Whether budgeting for stability, investing for growth, or exploring digital wealth, these apps ensure that everyone can take charge of their financial future with confidence.